- Whale transfer and rising exchange reserves stirred speculation around XRP’s next major move.

- Technical breakout and on-chain growth aligned with liquidation zones to support bullish momentum.

A massive transfer of 66.9 million XRP, valued at over $143 million, between unknown wallets has stirred renewed excitement around the token. This significant whale activity coincides with Ripple[XRP] holding firmly above the $2.00 psychological support.

At press time, XRP was trading at $2.12, posting a 3.97% gain in the past 24 hours. Therefore, attention now shifts to whether this bullish setup can drive a rally toward the $2.60 resistance level.

Rising exchange reserves: Should traders worry or prepare?

According to on-chain data, XRP’s total exchange sat at $6.066 billion at press time, marking a 5.9% increase in the past 24 hours. Typically, rising exchange reserves indicate a potential increase in selling pressure as more tokens become accessible for trading.

However, not all inflows lead to immediate dumps. Sometimes, these transfers are strategic, preparing for upcoming liquidity events or major accumulation zones.

Source: CryptoQuant

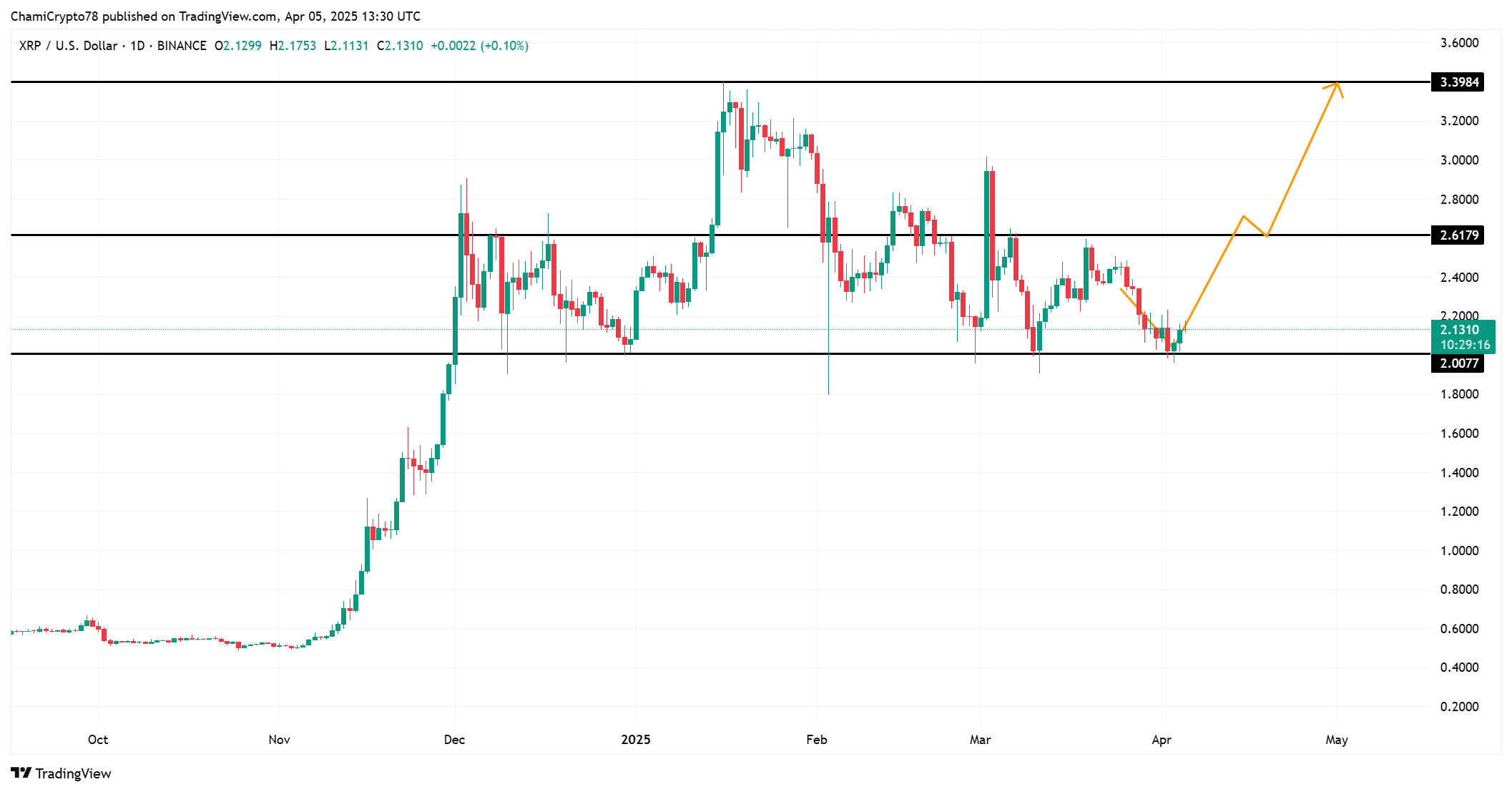

XRP technical chart: Setting up for the next leg higher?

XRP is respecting a well-defined range, bouncing strongly from the $2.00 support level for the third time since early March. The current structure suggests the formation of a higher low, signaling a bullish shift in momentum.

If buyers push the price above the $2.61 resistance level, a swift move toward the $3.39 region could unfold. Additionally, a breakout above this range would confirm trend continuation, attracting fresh momentum traders into the market.

Source: TradingView

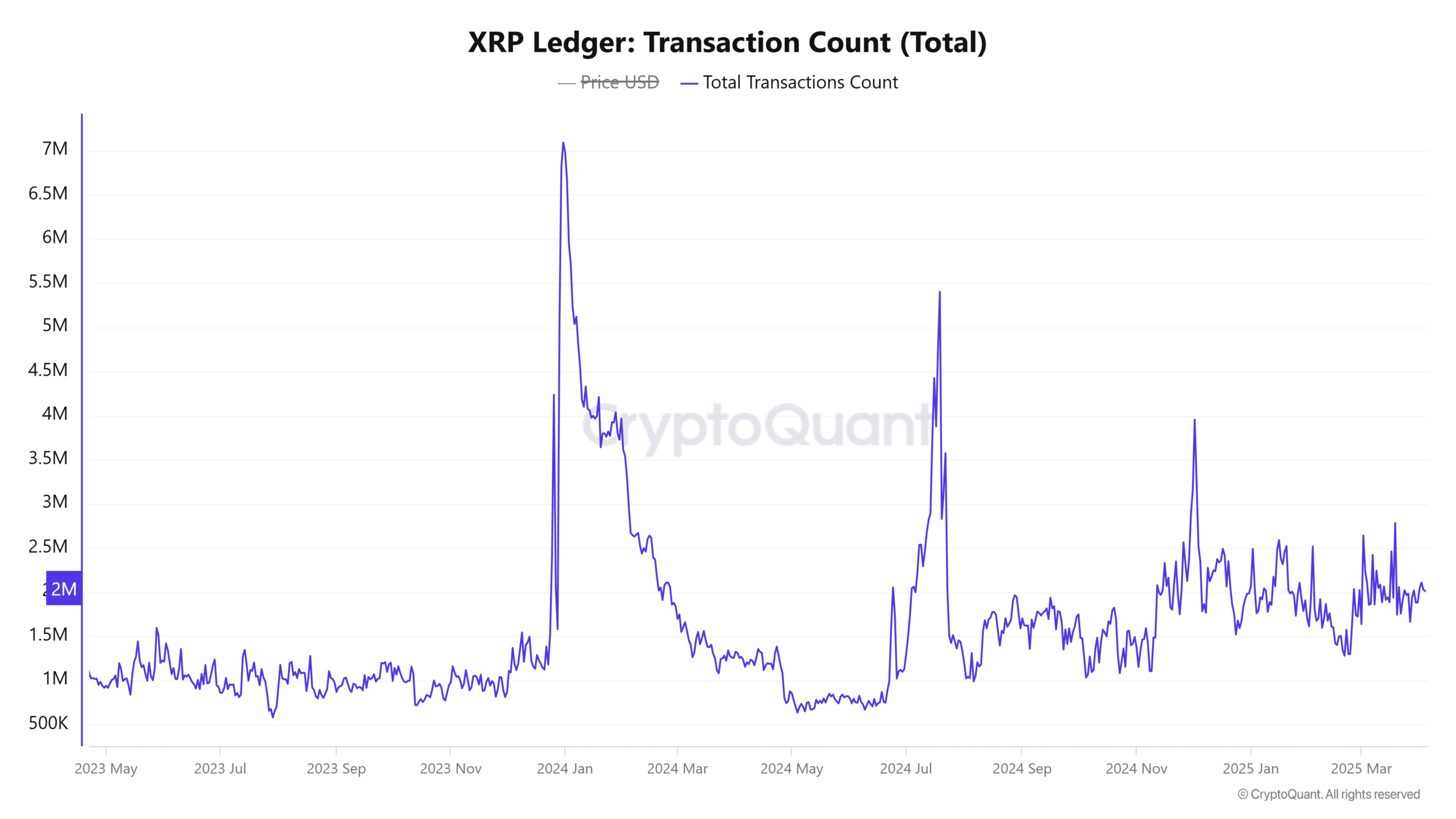

On-chain activity is heating up—What does it mean?

On-chain metrics showed encouraging signs of renewed network participation. Active addresses grew by 0.92% over the past 24 hours, reaching 21,057 unique wallets. Additionally, the transaction count also rose by 0.96%, crossing 1.94 million.

These increases reflect rising user engagement, often preceding or accompanying price rallies. Therefore, the uptick in address activity aligns with the growing optimism surrounding XRP’s near-term potential.

Source: CryptoQuant

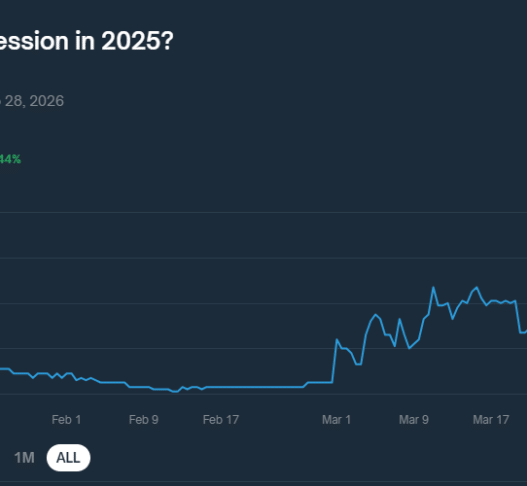

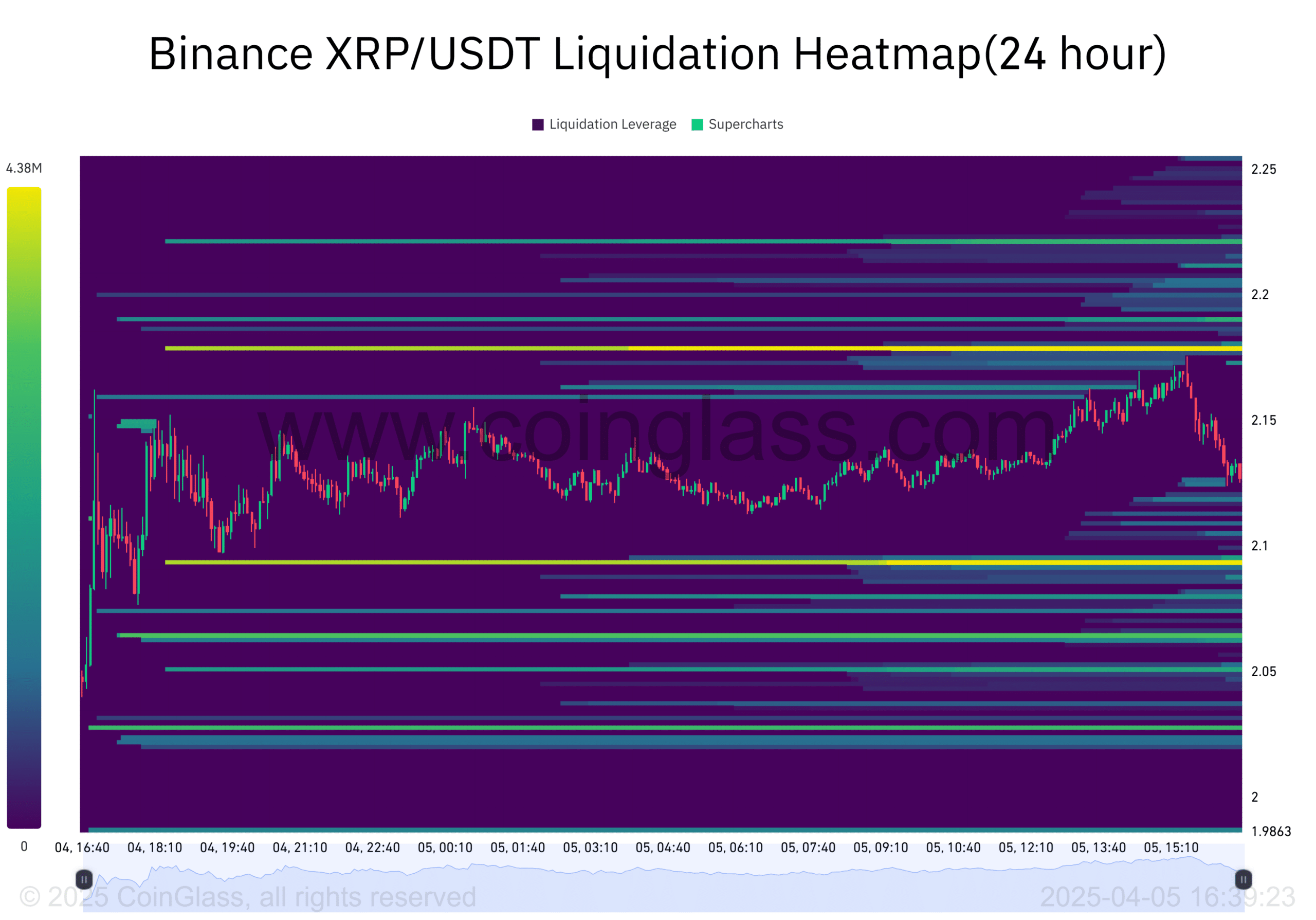

Liquidation heat map: Where will the squeeze happen?

The Binance liquidation heatmap shows dense liquidation clusters between $2.15 and $2.25. These levels could act as short-term hurdles, yet they also serve as fuel for a potential breakout.

Once price breaches these areas, short liquidations may trigger a cascading push toward $2.60 and possibly higher. Therefore, this setup could quickly shift into a high-volatility rally if momentum sustains.

Source: Coinglass

Is XRP poised for a $2.60 breakout?

XRP appears to be on the verge of a breakout toward $2.60. Strong whale movement, bullish technical structure, growing on-chain activity, and layered liquidation levels support this outlook.

Unless a sharp reversal breaks below $2.00, XRP’s momentum remains firmly intact. Traders should prepare for a potentially explosive upside move.