Key Takeaways

Who is this ETF suitable for?

Tactical traders seeking high-beta exposure, not long-term holders, due to volatility and leverage drag.

What are the key risks?

Market volatility, liquidity limits, basis management, and potential NAV swings from rebalance mechanics.

In a recent turn of events, 21Shares is making a bold move in the crypto ETF space by filing for a 2x leveraged Hyperliquid [HYPE] ETF with the U.S. Securities and Exchange Commission (SEC).

HYPE ETF details

According to the filing, the proposed ETF aims to provide investors with 2x daily exposure to the HYPE Index, a decentralized platform gaining momentum in the crypto space.

Designed as a high-beta investment tool, the ETF allows traders to benefit from HYPE’s increasing on-chain activity and market volatility.

With this product, 21Shares intends to offer a strategic vehicle for navigating the fast-changing world of decentralized finance.

Crypto community reacts

Remarking on the same, Senior ETF analyst at Bloomberg Eric Balchunas noted,

“21Shares filing for a 2x HYPE ETF. This is the kind of filing where you’re like man, that is SO niche, idk.. but then you could look up in 3-4yrs it’s got a few billion. Just a total land rush right now, just like with themes, curr hedging and smart beta in eras past.”

Echoing similar sentiments, Shanaka Anslem Perera added,

“21Shares 2x HYPE ETF isn’t “just another levered ETF.” … It’s the first serious attempt to wrap a live on-chain cash-flow machine (Hyperliquid perps via $HYPE) into a 40-Act-style, daily-reset product.”

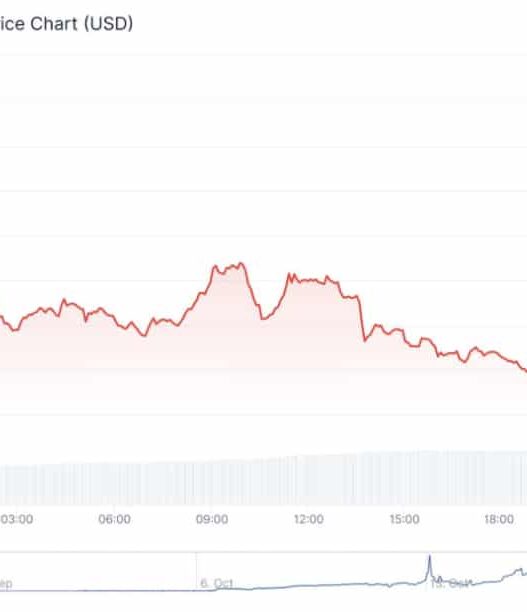

HYPE price action and more

Beyond HYPE itself, the ETF represents a broader opportunity to monetize DeFi revenue streams.

At press time, Hyperliquid traded at $34.39, down 10.87% in 24 hours, reflecting market sensitivity amid these developments.

Meanwhile, investor caution is intensifying as HYPE faces multiple headwinds.

The upcoming $11.9 billion token unlock in November has heightened fears of value dilution, prompting early profit-taking by whales.

High-profile sales, including Arthur Hayes reportedly liquidating part of his HYPE holdings, have amplified market panic.

Adding to the pressure, rising competition from Aster [ASTER] is diverting trading volume away from Hyperliquid, challenging HYPE’s dominance in the perpetual DEX space.

Combined, these factors are creating a cautious trading environment, leaving HYPE vulnerable to further short-term downside.