Key Takeaways

What’s driving Zcash’s rebound?

ZEC rose 12% after Open Interest hit $237 million, signaling renewed leverage activity and strong retail buying pressure.

How high can it go?

Sustained demand above $250 could push ZEC past $300, with momentum building toward its $391 all-time high.

Zcash [ZEC] rebounded sharply over the past 24 hours, gaining 12% from its recent dip at press time, and reignited investor attention.

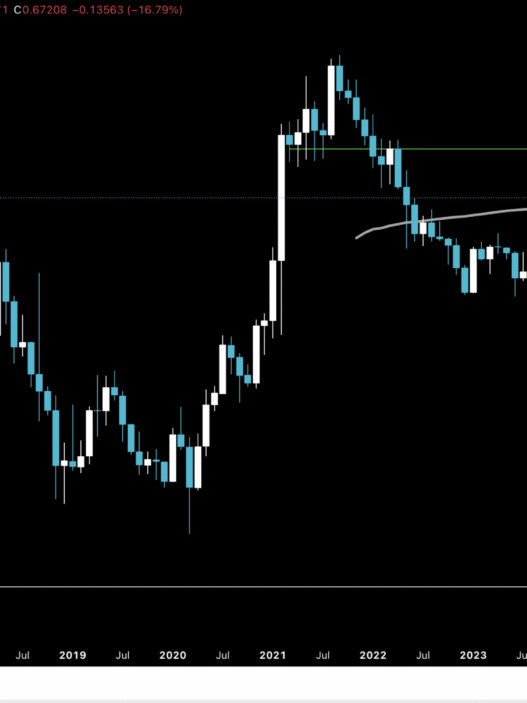

The daily chart showed that the broader trend remained bullish, with $298 as the next key resistance target.

In fact, the Stochastic RSI approached the oversold zone near 30, hinting that the latest rebound could mark the end of the short-term correction.

That left traders watching whether ZEC’s bullish spark could evolve into a sustained rally.

Source: TradingView

Leverage piles up as Open Interest hits $237M

According to data from Coinalyze, ZEC’s Open Interest (OI) climbed by 10% in the past day, reaching $237 million.

The uptick reflected a surge in leveraged positions and speculative inflows, a familiar sign of traders rushing to capitalize on short-term momentum.

From the previous observations, such spikes tend to precede volatile phases as markets adjust to overextended leverage, making the next few sessions critical for ZEC’s direction.

Source: Coinalyze

At the same time, ZEC retail traders have been particularly active, driving liquidity and fueling optimism across exchanges.

Accumulation clusters formed around current price levels, suggesting that smaller investors were fueling liquidity. That behavior mirrored previous altcoin rallies, where early retail inflows typically preceded larger institutional entries.

If ZEC sustains its current accumulation, the altcoin could attract institutional attention once again.

Source: CryptoQuant

Spot strength vs. speculative fragility

While the momentum looked promising, the sustainability of ZEC’s move hinges on more than short-term enthusiasm.

For your understanding, leverage-driven rallies can quickly lose steam if they lack follow-through from spot market buyers or long-term holders.

Data from CryptoQuant showed both Spot Taker CVD and Futures Taker CVD in Taker Buy Dominant territory, confirming active demand.

Yet, sustained upside required deeper participation from whales and institutions.

Source: CryptoQuant

On top of that, maintaining support around the breakout zone remained critical. A strong defense there could keep momentum intact toward $300.

If OI and spot demand continue rising together, ZEC could retest $300 and possibly aim for its next psychological mark near $391, its all-time high.