Satoshi Nakamoto, the pseudonymous creator of Bitcoin (BTC), is the largest BTC holder in the world at the time of this writing, and the wallets controlled by Satoshi took an unrealized loss of over $20 billion since the all-time high price of over $126,000 reached in early October.

Nakamoto’s Bitcoin stash contains over 1 million BTC, valued at over $117.5 billion at the time of this writing, according to data from Arkham Intelligence.

The portfolio swelled to over $136 billion during Bitcoin’s rally to new all-time highs of over $126,000 during the first week of October.

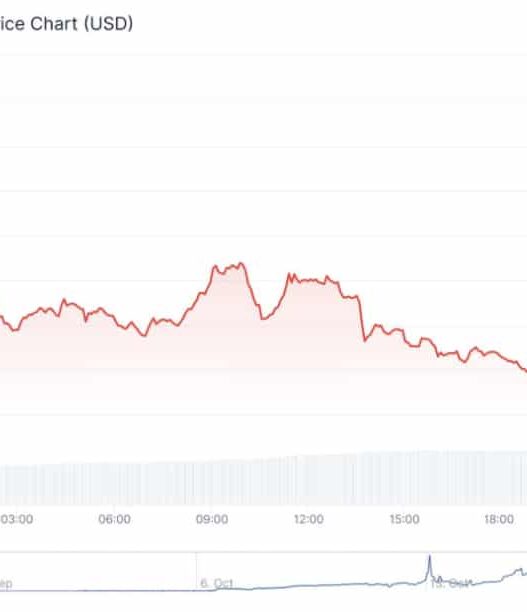

However, crypto markets were rocked by cascading liquidations in the perpetual futures market on October 8, ignited by a post from US President Donald Trump signaling added tariffs on China, which sparked investor fears of a renewed trade war.

The market rout caused $20 billion in liquidations, the worst 24-hour liquidation event in the history of crypto, sending prices crashing, with the value of some altcoins declining by over 99%. However, Bitcoin showed resilience, remaining above the $100,000 level.

Related: Precious metals trade ‘overheated,’ investors to rotate into BTC: Analyst

Market crash is a temporary setback, not a reevaluation of fundamentals

The market crash that began on October 8 is only a short-term decline and “does not have long-term fundamental implications,” according to investment analysts at The Kobeissi Letter.

Multiple technical factors contributed to the market meltdown, including excessive leverage, thin market liquidity, which heightens volatility and exacerbates the effect of large, sudden moves, and Trump’s social media post, The Kobeissi Letter wrote.

“We think a trade deal will be reached, and crypto remains strong. We are bullish,” the analysts continued.

Days earlier, The Kobeissi Letter said that Bitcoin’s all-time high coincided with the US dollar’s weakest year since 1973, which signals a major macroeconomic shift.

Moreover, risk-on asset prices are increasing at the same time as store-of-value and bearer assets like gold and BTC, an unusual phenomenon as these asset classes tend to run counter to each other, adding weight to the Kobessi analysts’ macroeconomic thesis.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling: Joseph Chalom