The artificial intelligence company xAI owned by billionaire Elon Musk has secured commitments of $500 million from investors to achieve a goal of $1 billion, according to a report published by Bloomberg.

The company is discussing a valuation between $15 billion and $20 billion, though terms could change in the coming weeks.

Elon Musk launched his startup last year as a replacement for Open AI, which he co-founded and later left over philosophical differences over how to leverage the technology.

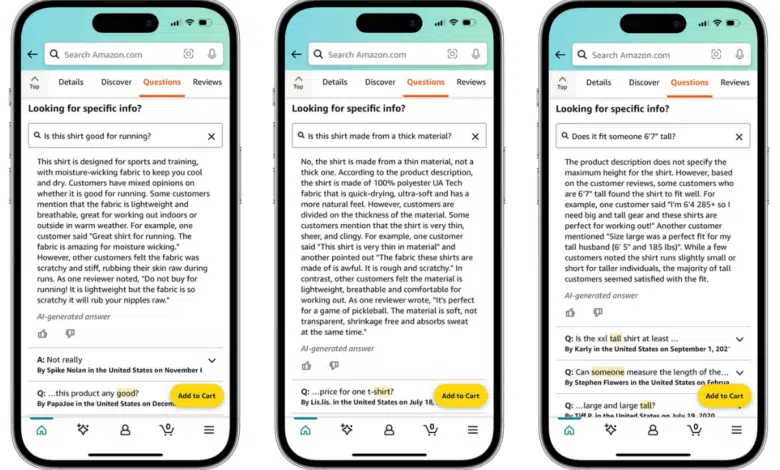

The artificial intelligence chatbot Grok is xAI’s first product, and it was developed based on posts on the social media platform X, which Musk also owns.

This gives Grok chatbot access to more recent data when responding to users than other chatbots.

Investors of the two companies are likely to overlap as well, and Elon Musk has received support from Larry Ellison, Sequoia Capital, Andreessen Horowitz, and Fidelity regarding his $44 billion acquisition of Twitter.

Musk said in November that X investors would own 25 percent of XAI.

In practice, this means that these investors are invited to invest in xAI in the amount of 25 percent of the amount they invested in xAI.

If they invest $10 billion in xAI, this means they are invited to invest $2.5 billion or more in xAI.

Musk and investors are expected to finalize the terms in the next two weeks.

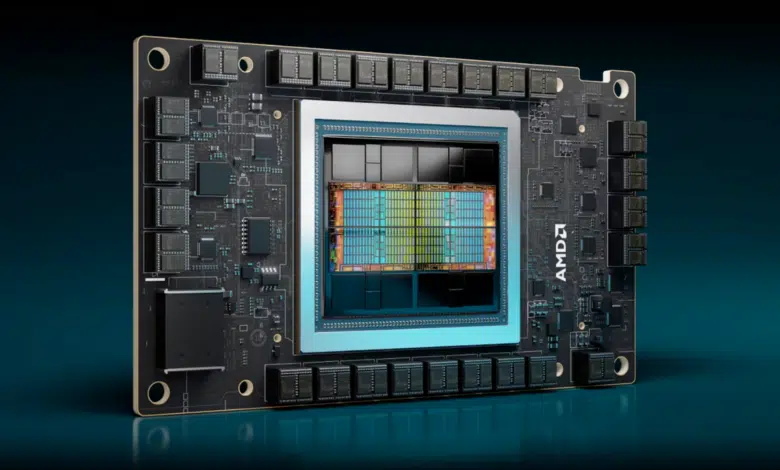

Some parties are considering acquiring computing power in addition to XAI shares, while others are considering acquiring computing power instead of XAI shares.

Computing power is useful for investment companies that need intensive data processing in order to build new artificial intelligence products.

In a related context, Elon Musk denied the Bloomberg report, explaining that the report stating that his artificial intelligence company xAI obtained commitments of $500 million from investors to achieve a goal of one billion dollars is inaccurate.

He said in response to a user regarding the report on the social media platform X: “This information is inaccurate.”

It is noteworthy that Musk said last December that his artificial intelligence company was not raising money, one day after the startup submitted an application to the US Securities Commission to raise $1 billion through the sale of shares.